On April 5, 2022, Vietnam Report Joint Stock Company (Vietnam Report) officially announced the Top 10 Prestigious Companies in the Construction - Building Materials industry in 2022.

This is an independent research result of Vietnam Report, built on scientific and objective principles. The reputation of companies is assessed based on research on the influence of financial factors, corporate image (DN) in the media and assessment of industry stakeholders, specifically including: 1) Financial capacity shown on the most recent financial statement; (2) Media reputation is assessed by Media Coding method - encoding articles about the enterprise on influential media channels; (3) Survey of research subjects and stakeholders in the period of 2021 - 2022 is also used as an additional factor to determine the position of enterprise in the industry.

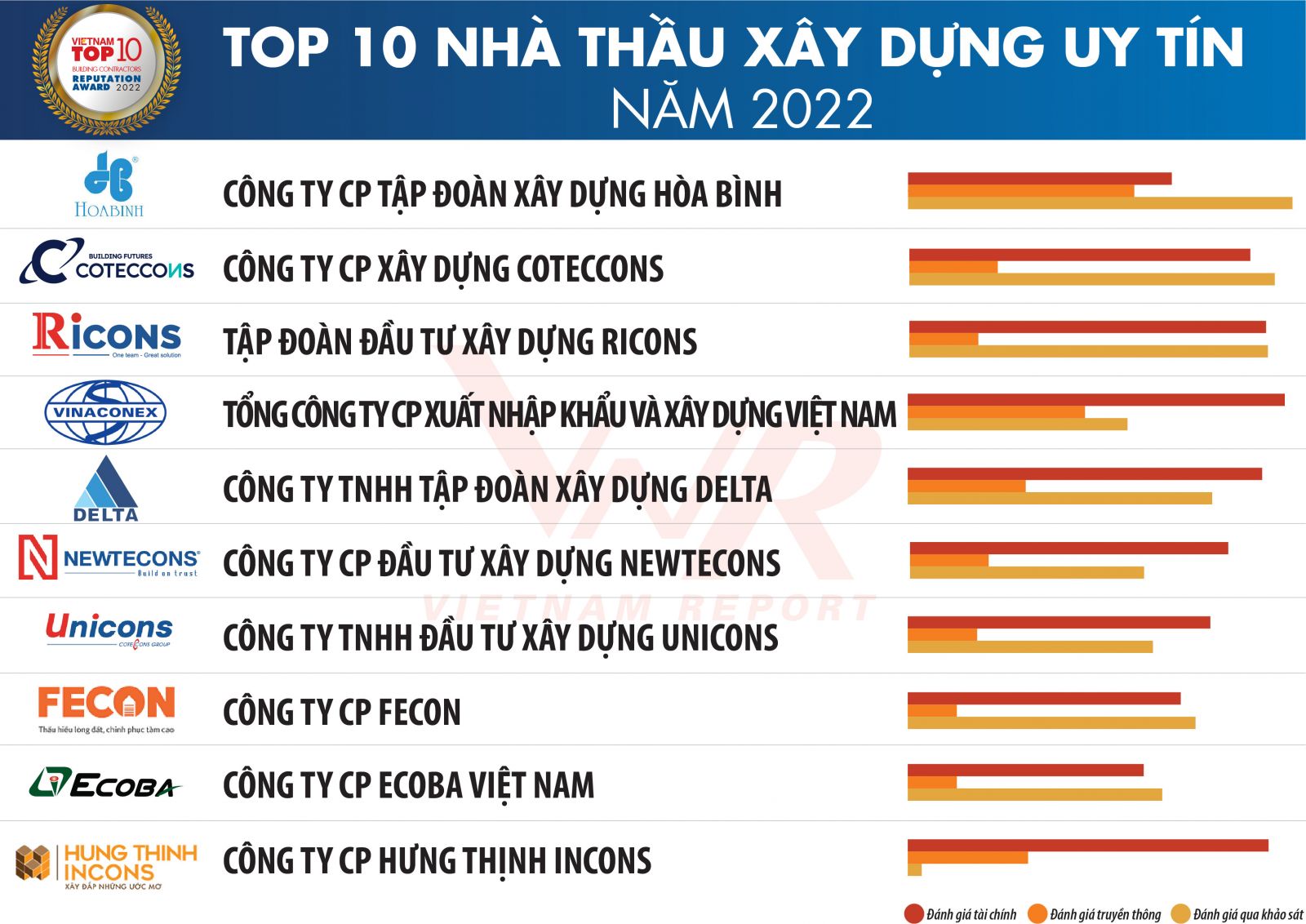

List 1: Top 10 prestigious Construction Contractors in 2022

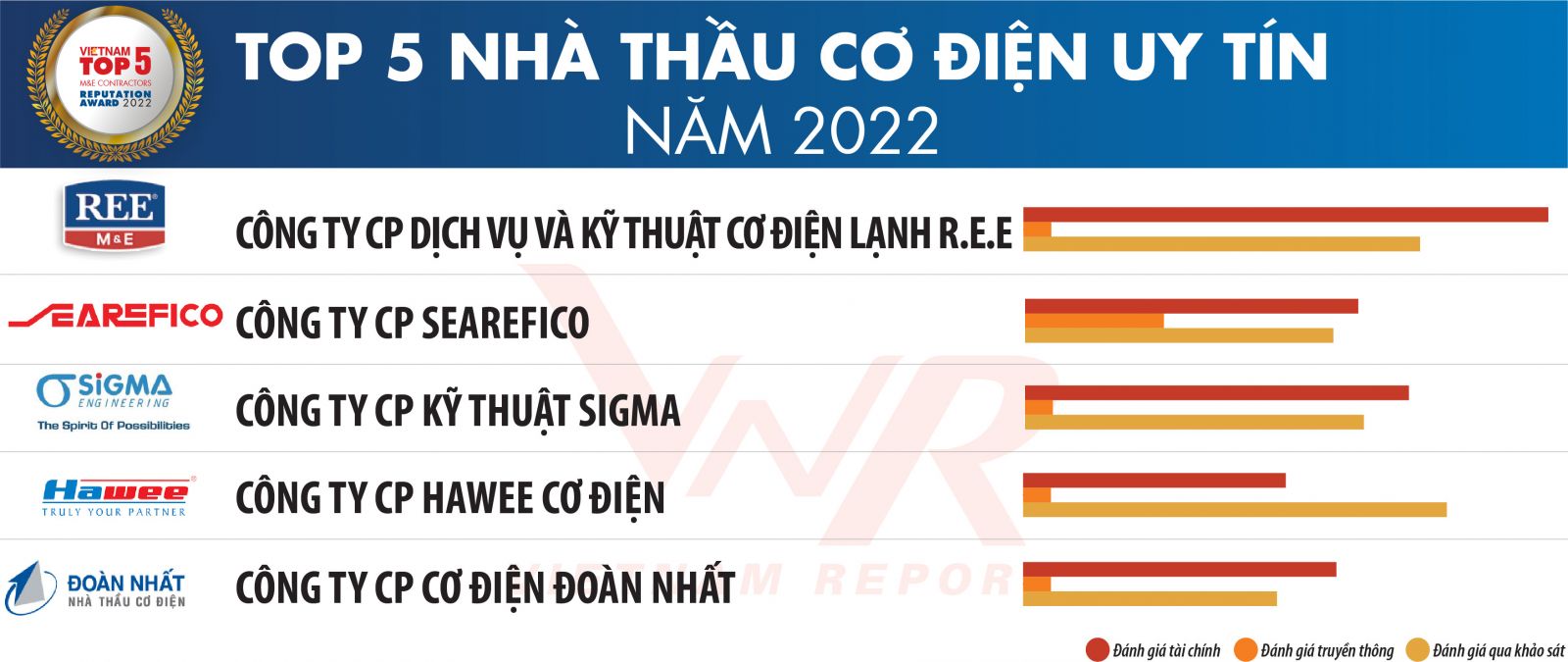

List 2: Top 5 prestigious Vietnamese M&E contractors in 2022

List 3: Top 10 prestigious Building Material Companies in 2022

.jpg)

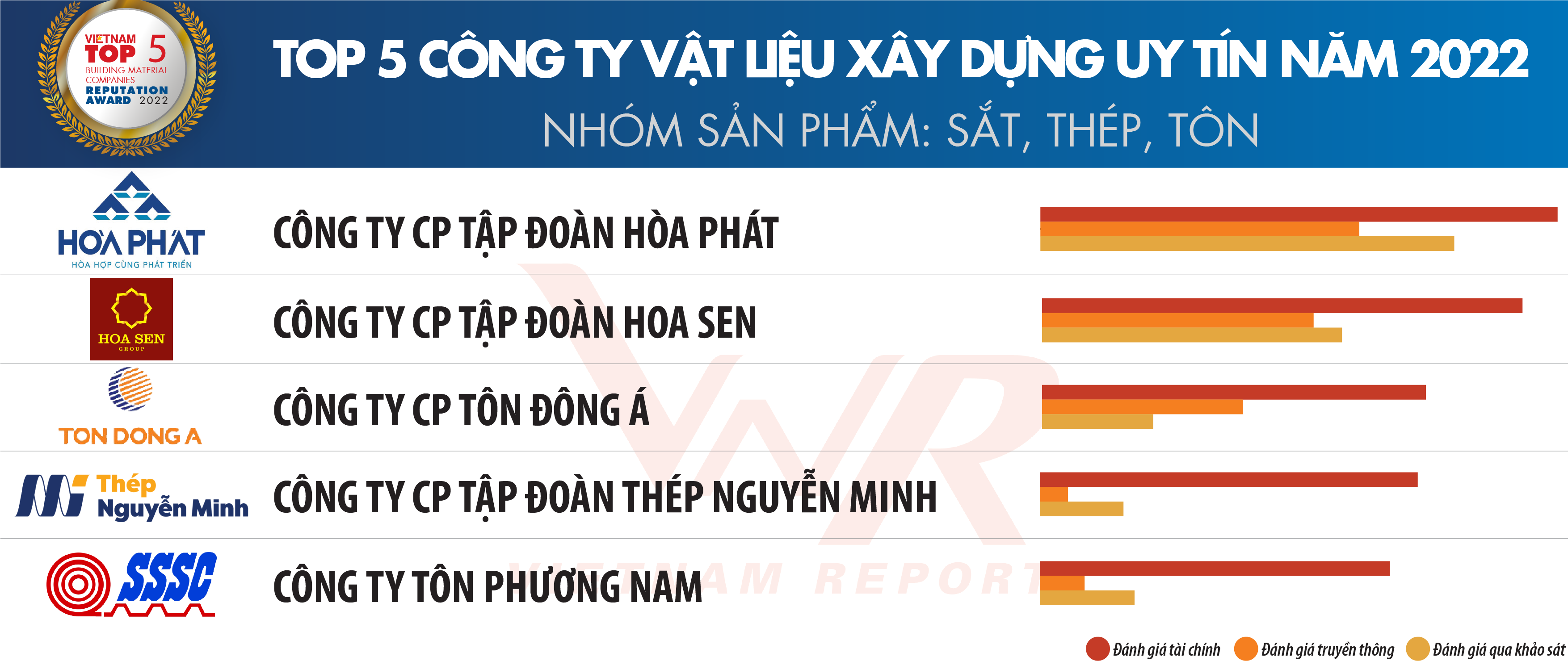

Danh sách 4: Top 5 Công ty vật liệu xây dựng uy tín năm 2022 – Nhóm sản phẩm: Sắt, thép, tôn

Nguồn: Vietnam Report, Top 10 Công ty uy tín ngành XD-VLXD năm 2022, tháng 4/2022

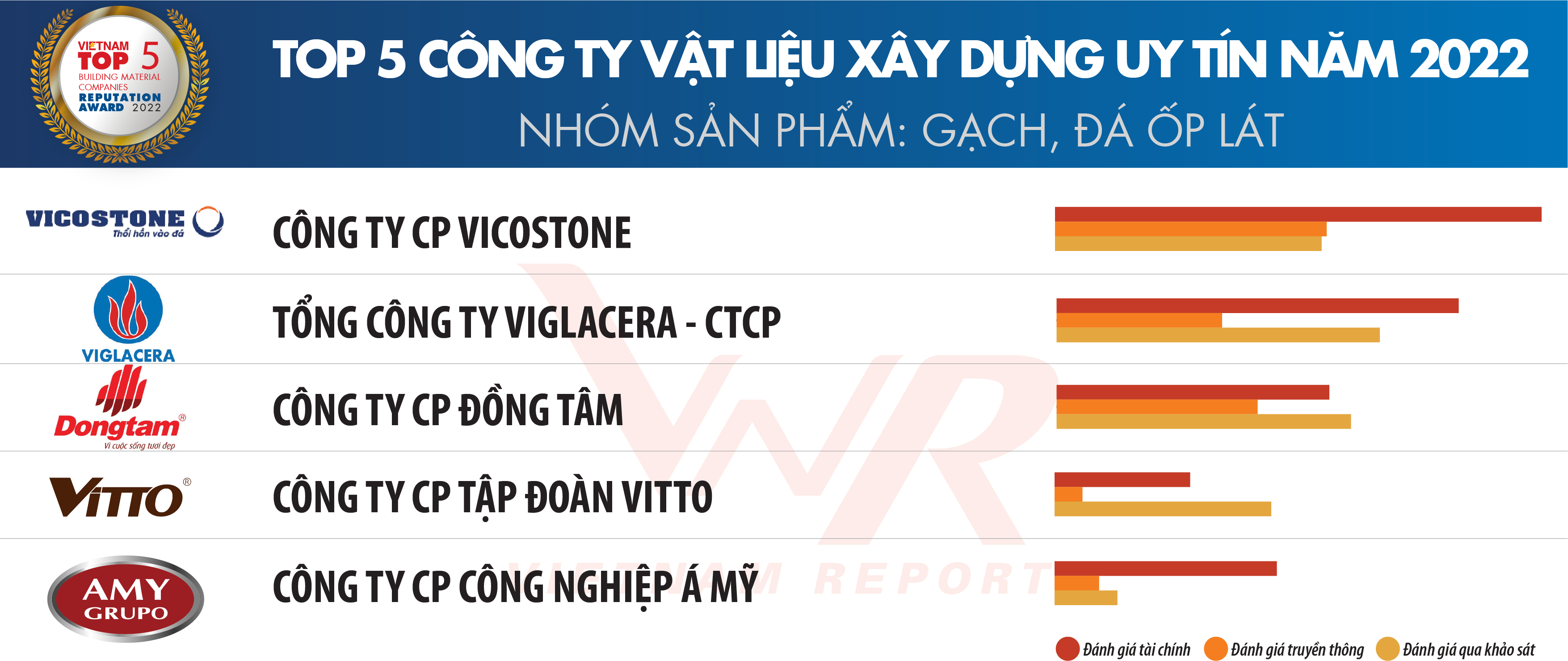

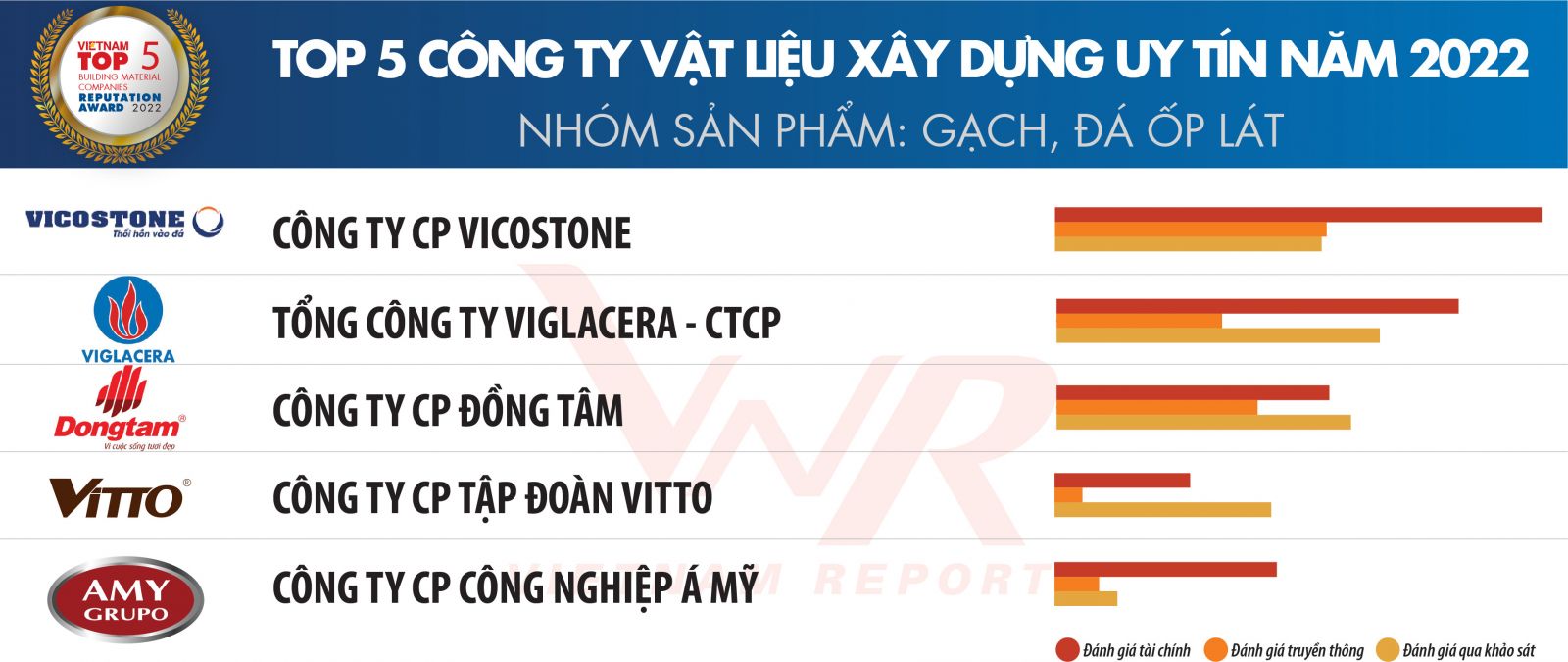

Danh sách 5: Top 5 Công ty vật liệu xây dựng uy tín năm 2022 – Nhóm sản phẩm: Gạch, đá ốp lát

Nguồn: Vietnam Report, Top 10 Công ty uy tín ngành XD-VLXD năm 2022, tháng 4/2022

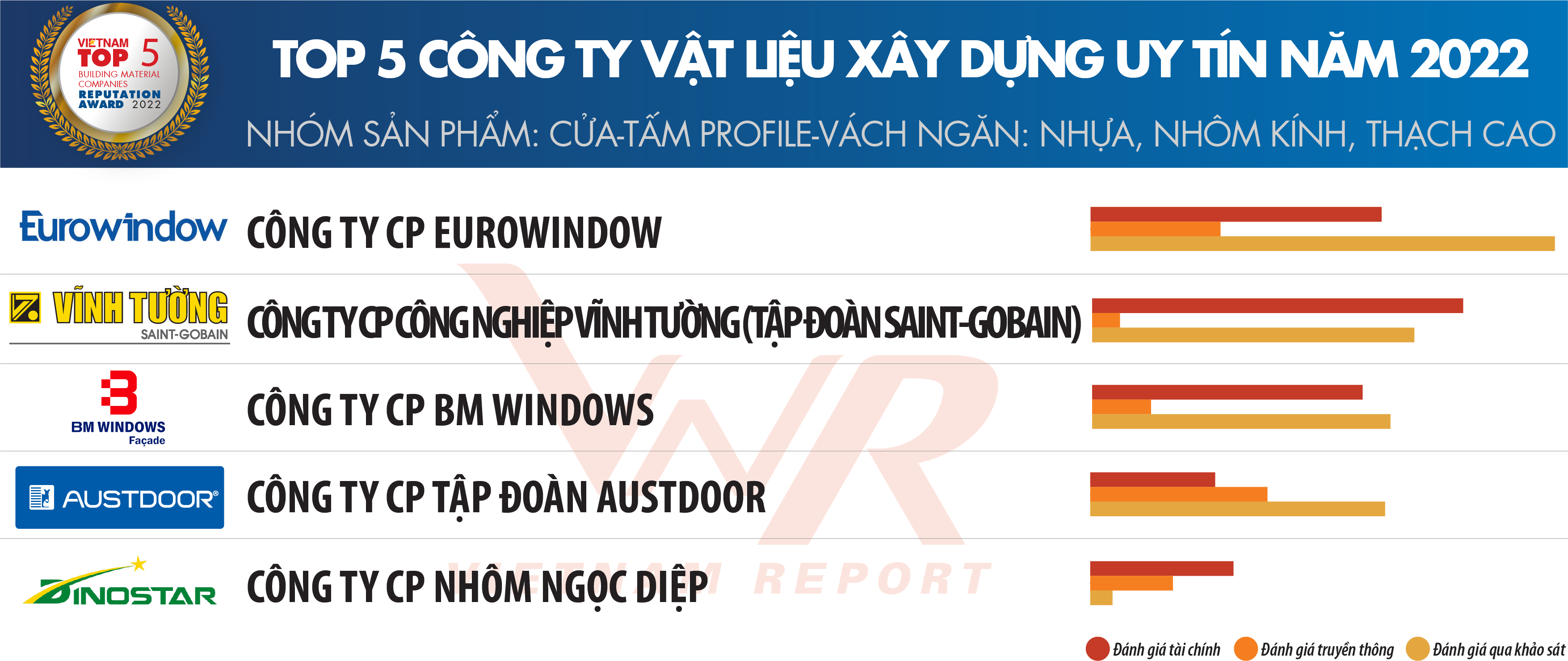

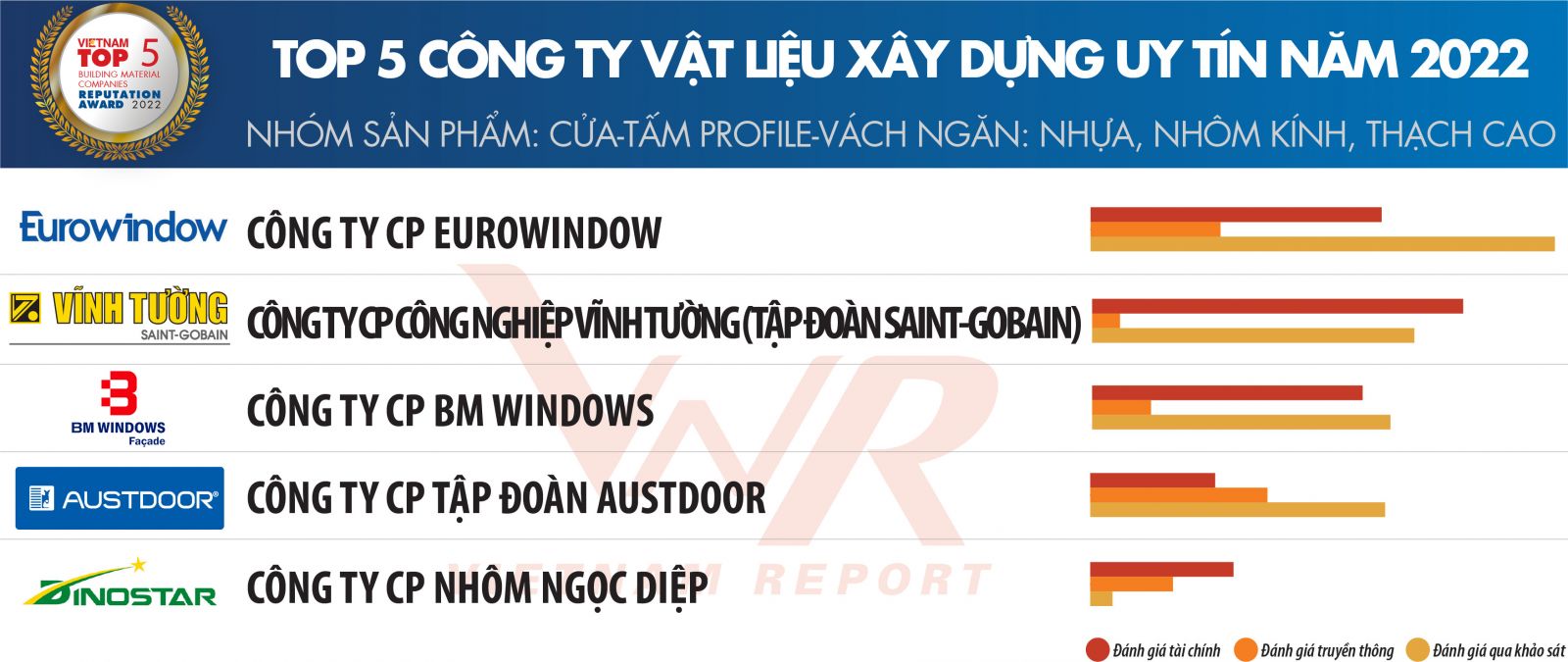

Danh sách 6: Top 5 Công ty vật liệu xây dựng uy tín năm 2022 – Nhóm sản phẩm: Cửa - tấm profile - vách ngăn: nhựa, nhôm kính, thạch cao

Construction industry in 2021: Persevering to overcome difficulties

The construction industry has experienced a difficult year 2021 due to the negative effects of the COVID-19 pandemic. In the first 6 months of the year, thanks to the experience gained from 2020 and the good adaptation of the enterprises, the growth of the industry reached 5.59%, higher than the growth rate of the same period in 2020 of 4.54%. However, under the prolonged impact and strong outbreak of the fourth wave of the epidemic, many localities including Hanoi and Ho Chi Minh City was forced to implement social distancing. Most of the projects located in the isolated provinces had to stop construction. The projects located outside the isolation area were also delayed due to disruptions in the supply of materials and human resources. The most visible economic losses are: the cost of maintaining the apparatus, the cost of epidemic prevention and control, the cost of mobilizing resources after the social distancing... 37.9% of the enterprises participating in Vietnam Report's survey showed, over 20% of their projects/contracts were delayed or affected by costs due to the COVID-19 pandemic. In addition to the complicated developments of the epidemic, fluctuations in the price of raw materials have become a "nightmare" for construction contractors. The price index of raw materials, fuel and construction materials increased by 6.4% over the same period last year due to high demand for construction materials while the supply chain has not been interrupted since 2020. Two types of building materials which are the most important steel and cement whose prices increased by 40% and 8.4%, respectively. Since the cost of construction materials accounts for about 65 - 70% of the estimated cost of construction, the increase in the price of construction materials directly affects the cost of construction investment, the efficiency of many projects, and the erosion of the margins of the enterprises. Some industry experts believe that the "price storm" has wiped out the remaining possible profits, pushing many enterprises into losses.

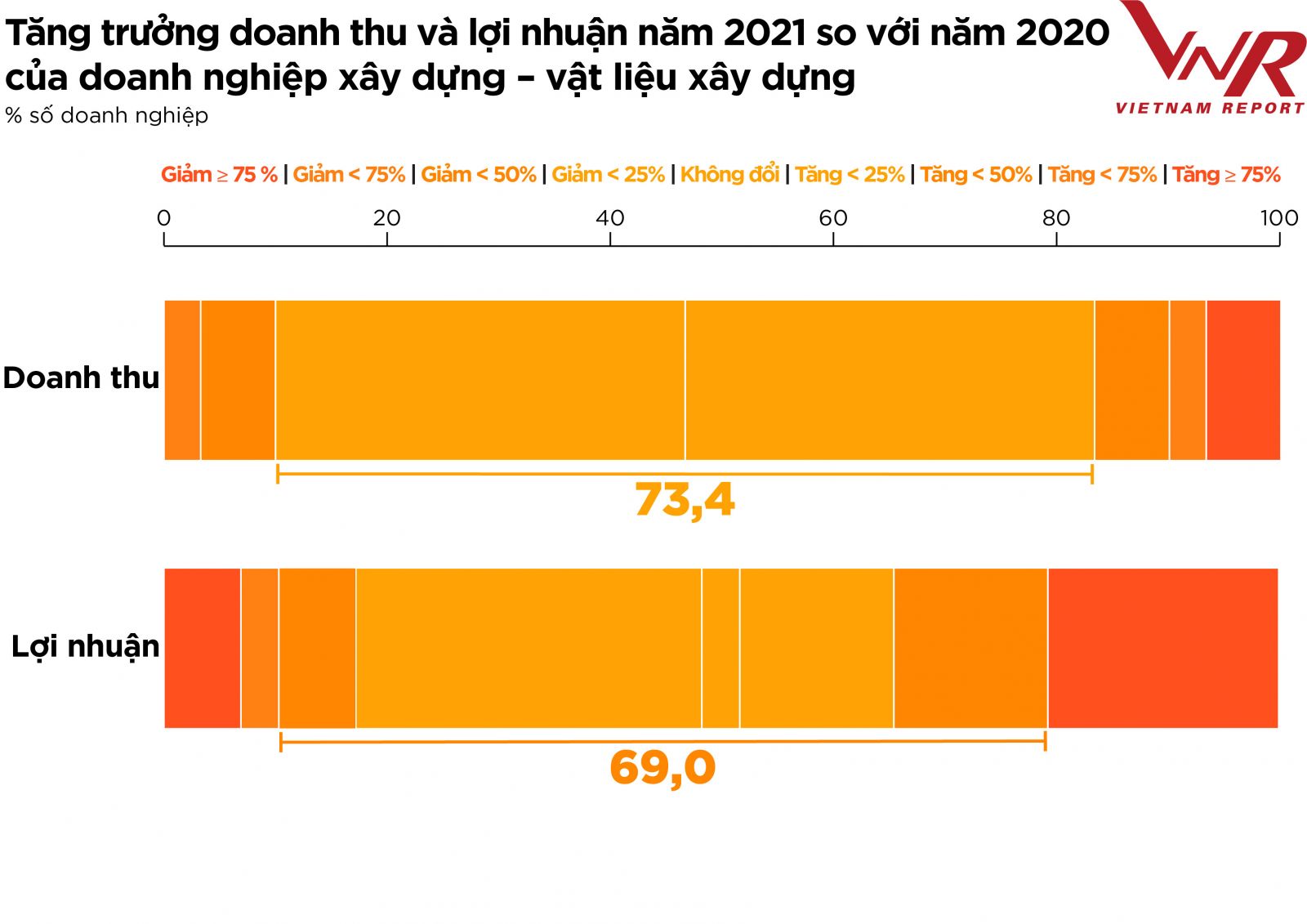

Figure 1: Revenue and profit growth in 2021 compared to 2020 of construction - building materials enterprises

Source: Vietnam Report, Survey of construction and building materials enterprises in 2022, February-March, 2022

According to the General Statistics Office of Vietnam, the growth rate of the whole industry in 2021 will only reach 0.63% - this is a very low level compared to the average growth rate of 7.2% in the past 10 years. The survey by Vietnam Report showed that 53.3% of enterprises in the industry still recorded growth in revenue, although the growth rate was mainly below 25%. The survey also showed that the revenue fluctuation of most businesses was in the 25% increase/decrease range while the profit margin was larger, in the 50% increase/decrease range. This was a very encouraging result in the context of overlapping difficulties. According to the majority of experts interviewed by Vietnam Report, the most important and decisive contribution to the positive business results was the shift from "fighting the epidemic like fighting the enemy" to "living together safely and adapting to the pandemic” of the Government. 72.4% of enterprises believe that this trend will be the leading factor driving growth in 2022.

Brand reputation accompanies enterprises in the context of many fluctuations

If changing attitudes towards COVID-19 from "enemy" to "living together" is an important turning point, creating business recovery in the fourth quarter of 2021, corporate reputation is a strong motivation helps 96.6% of enterprises in the industry persistently overcome consecutive difficulties throughout the past year (according to a survey of Vietnam Report). Building a reputable brand takes time, especially for the enterprises in the Construction - Building materials industry because the construction time usually lasts from 2-3 years, not to mention the product life cycle/ Projects (design, material production, construction, use, demolition) can last up to several decades. To be able to build a strong brand, the enterprises need to simultaneously develop the following 7 aspects: Product, Innovation, Working Environment, Social Responsibility, Governance, Leadership and Business Results, not just 1 or 2 aspects. Assessing the reputation of enterprises in the Construction industry – Building materials should be concerned with all stakeholders such as Employers, customers, partners, competitors, distributors, employees in such enterprise…

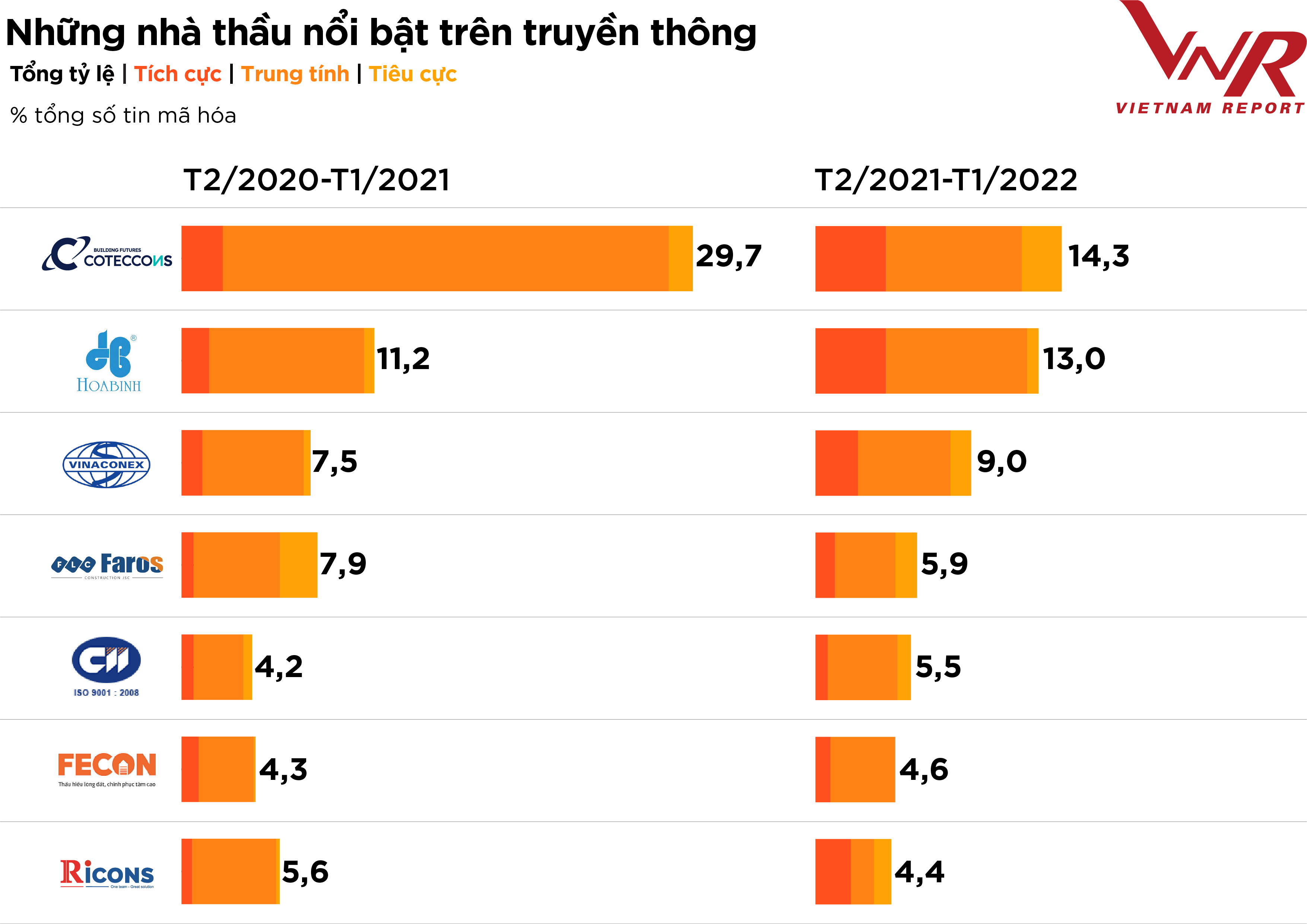

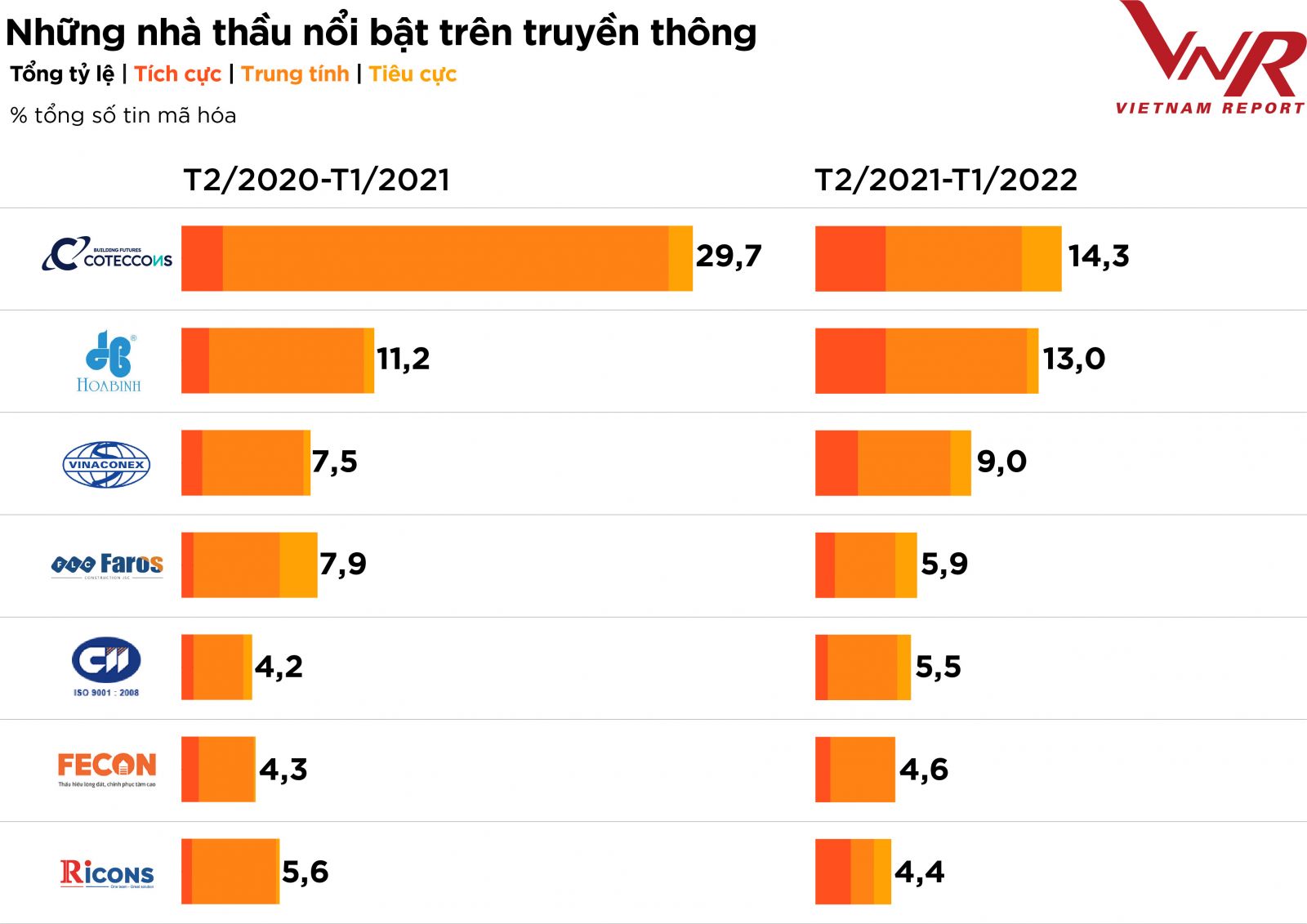

According to Vietnam Report, the media plays an important role in directly connecting stakeholders in the industry value chain, thereby better identifying reputable brands when making investment or purchasing decisions. The results of the media analysis show that, although business activities are somewhat quiet due to the impact of the epidemic outbreaks, the communication activities of enterprises in the industry are still very active, most contractors have a high frequency of appearance in the media more than the previous year. Notably, the gap between the three contractors that attracted the most media, namely Coteccons, Hoa Binh and Vinaconex, has narrowed significantly, especially the gap between Coteccons and Hoa Binh. Besides, Ricons, Fecon are contractors with more effective communication activities in terms of information "safety" (the ratio of positive and negative news in total encrypted information of enterprise).

Figure 2: Prominent contractors in the media

Nguồn: Vietnam Report, Dữ liệu Media Coding các DN ngành XD-VLXD từ tháng 2/2020 đến hết tháng 1/2022

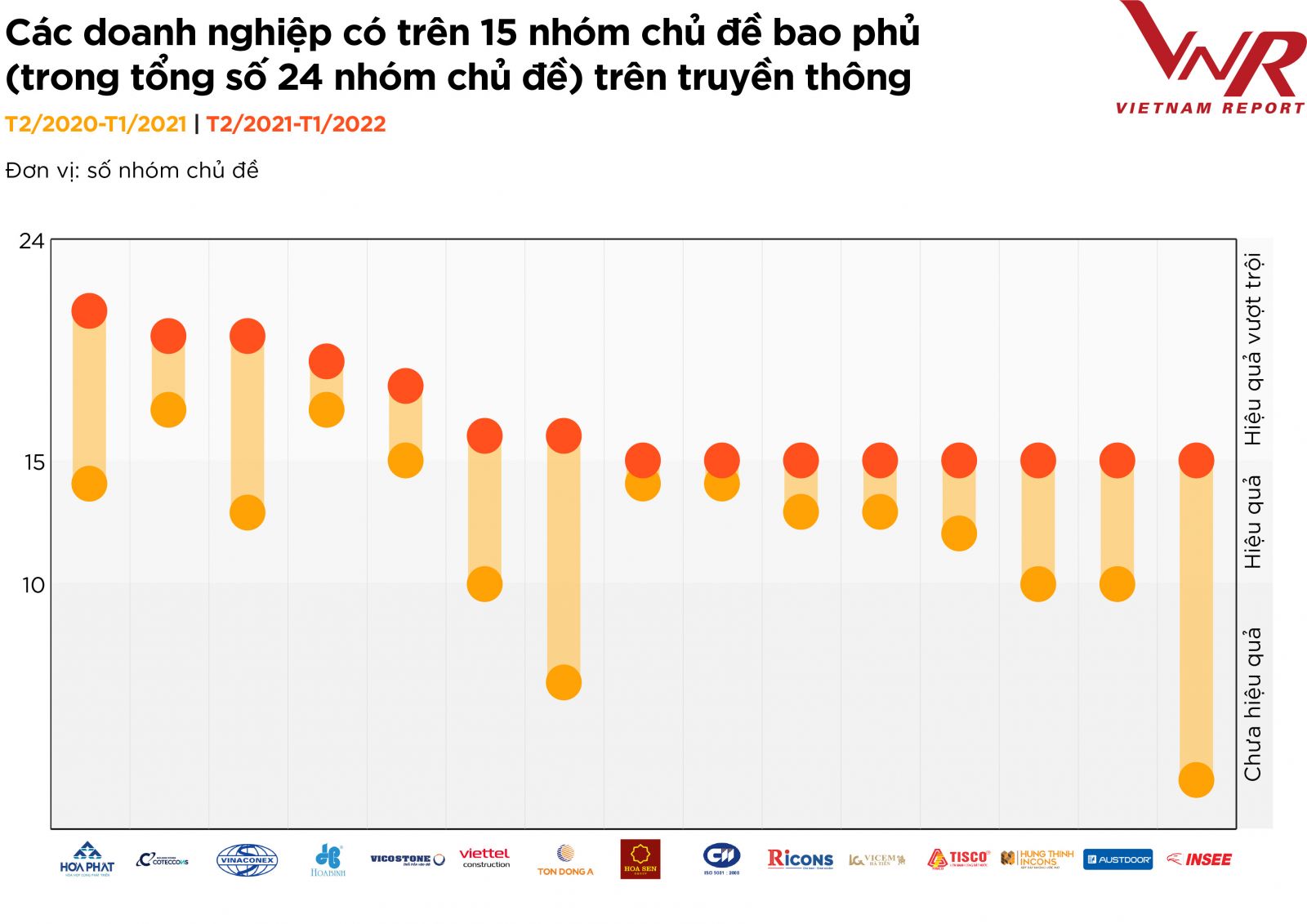

According to Vietnam Report, the enterprises are considered "effective" in terms of image diversity in the media when they have information coverage of 10/24 subject groups and "outstanding efficiency" if they reach 15/24 topic groups. The results of media analysis showed that 43.3% of enterprises in the industry achieved this "effective" level, a significant improvement compared to 34.7% in the previous period. Moreover, up to 15.0% of enterprises achieved "superior efficiency", 2.3 times higher than in the previous period, in which many enterprises jumped from "inefficient" to "superior efficiency” (Figure 3)

Figure 3: Enterprises with more than 15 topic groups covered (out of 24 topic groups) in the media

Source: Vietnam Report, Media Coding data of construction and building materials enterprises from February 2020 to January 2022

However, the media analysis by Vietnam Report also shows that, in the two years affected by the COVID-19 pandemic, it seems that the enterprises in the industry are quite confused in researching consumer tastes and behaviors as well as socially responsible activities. The rate of effective enterprises on the topic of Customers and products slowed down at 6.6%. Even for the topic of Social, social responsibility, the rate of effective enterprises decreased slightly by 0.8% from 5.5% in the previous period. The reason may be that the enterprises spend most of their resources on epidemic prevention, ensuring the production and business. Vietnam Report recommends the enterprises need to balance the proportions between news groups to ensure their image in the eyes of Employers, customers as well as the community is always updated regularly.

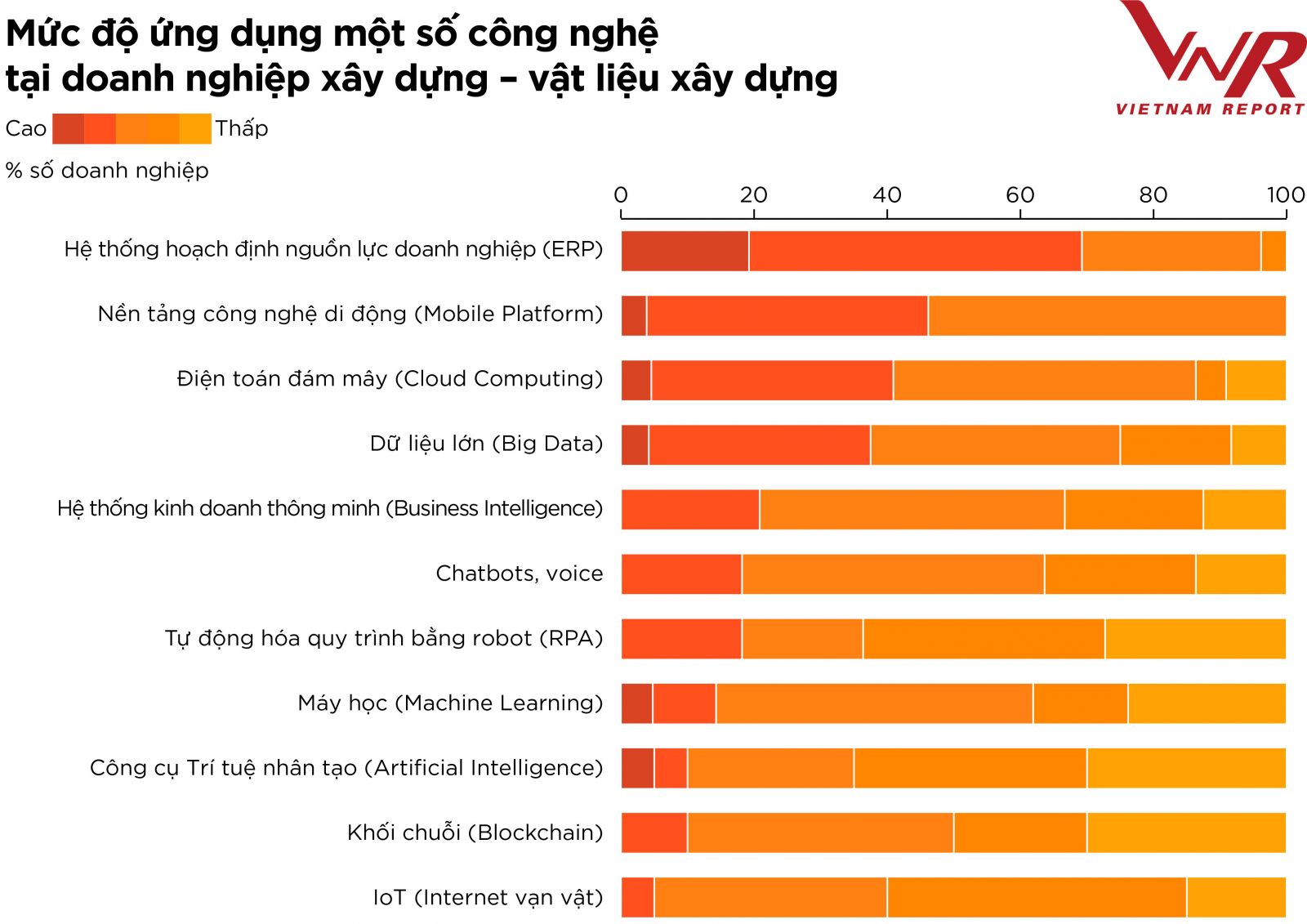

Bright spot from the journey of digitization

This is the biggest positive point in the difficult economic picture in the past period because the Construction - Building materials industry has always been slow in investment and technology application. According to a survey of Vietnam Report conducted in February 2022, nearly two-thirds of enterprises have embraced technology to maintain business operations during times of disruption, thereby reaping many benefits and address some of the industry's key issues: safety, productivity, and labor shortages. In which, the enterprise human resource planning system (ERP); Mobile technology platform; Cloud computing; and Big Data are 4 technologies with the highest level of application.

Figure 4: Level of application of some technologies in construction - building materials enterprises

Source: Vietnam Report, Survey of construction and building materials enterprises in 2022, February-March, 2022

The demand for technology application is becoming more and more strong when the majority of enterprises in the industry are investing in technology at a moderate or high level. The three technologies evaluated with the greatest potential for return on investment include: Advanced Data Analytics (65.5%), Building Information Modeling (BIM) (55.2%) and mobile platforms (31.0%).

Another positive point from the digitization process is that the business community has paid more attention to building a connected industry ecosystem. The core of the connected industry ecosystem is advanced data analytics and the application of cutting-edge technologies. These applications can put assets, people, processes, work… on one platform, make everything work smarter, reduce “downtime”, optimize performance and efficiency asset utilization, and better visibility in operations. At that time, the development, data analysis as well as the ability to provide detailed data about users play a very important role. As a result, the connected industry ecosystem will help the enterprises transform their problem-solving approach from reactive to predictive. In addition, another positive aspect of the connected industry ecosystem is better control of emissions through dynamic and continuous monitoring, not only during design and construction, but also during operation

Resilience – key to turning “risk” into “opportunity”

On March 11, the World Health Organization (WHO) reviewed the necessary criteria to declare the end of a global emergency on COVID-19, marking an important milestone after more than 2 years since when the pandemic broke out. Earlier, in early January 2022, WHO was also optimistic that the COVID-19 pandemic could end this year if global vaccination rates increased and countries worked together to control the spread of the disease. The unprecedented socio-economic crisis on a large scale is gradually coming to an end. This is also a time for us to look back and point out weaknesses or errors in the way problems are recognized and handled, thereby proposing new control measures or regulations to prevent similar events in the future.

Among economic sectors, the enterprises in the Construction - Building Materials industry in particular and the Real Estate - Construction - Building Materials industry ecosystem in general have been quite active in response to the effects of the pandemic thanks to crisis management experience gained more than ten years ago. A survey by Vietnam Report shows that 86.7% of enterprises in the industry have prepared well, reacted immediately, adapted well and suffered little impact; 6.7% of enterprises were not prepared but reacted quickly and decisively to recover. However, about 3.3% of enterprises are slow to respond and expect to recover in the future, and 3.3% of enterprises have not fully recovered. The question is, despite the initiative, why is growth still low? This suggests that a crisis management plan may not be enough. The enterprises are suffering the negative effects of neglecting to invest in business recovery strategies. The business resilience is understood as the ability of an enterprise to quickly adapt to disruptions, while maintaining business continuity and protecting people, assets and brand value in general. As such, resilience refers to crisis management and business continuity, responding to all types of risks an enterprise may face. In addition, business resilience also refers to the ability of enterprises to adapt to the new business environment after a crisis.

From the important lessons learned in the past 2 years of responding to the pandemic, Construction - Building materials enterprises participating in the Vietnam Report survey recognized the importance of building resilience when implementing projects and their capital allocation scored 4.3 on a 5-point scale – which is very important. The survey also showed that 100% of enterprises have been committed to taking drastic action to improve their resilience to future disruptions, of which 33.3% have complete with practical solutions; 43.3% of enterprises are in the process of implementing and 23.4% of enterprises are planning.

A number of studies have shown that the COVID-19 pandemic is not entirely unexpected. Therefore, an enterprise that invests well in business resilience will not only be able to overcome difficulties from risks and disruptions, but can also recover faster and accelerate growth during this next period. From the results from the above survey, we have a solid basis to put our faith in the prospect of recovery and acceleration of the whole industry in 2022.

Outlook 2022: Ready to accelerate, conquer new milestones

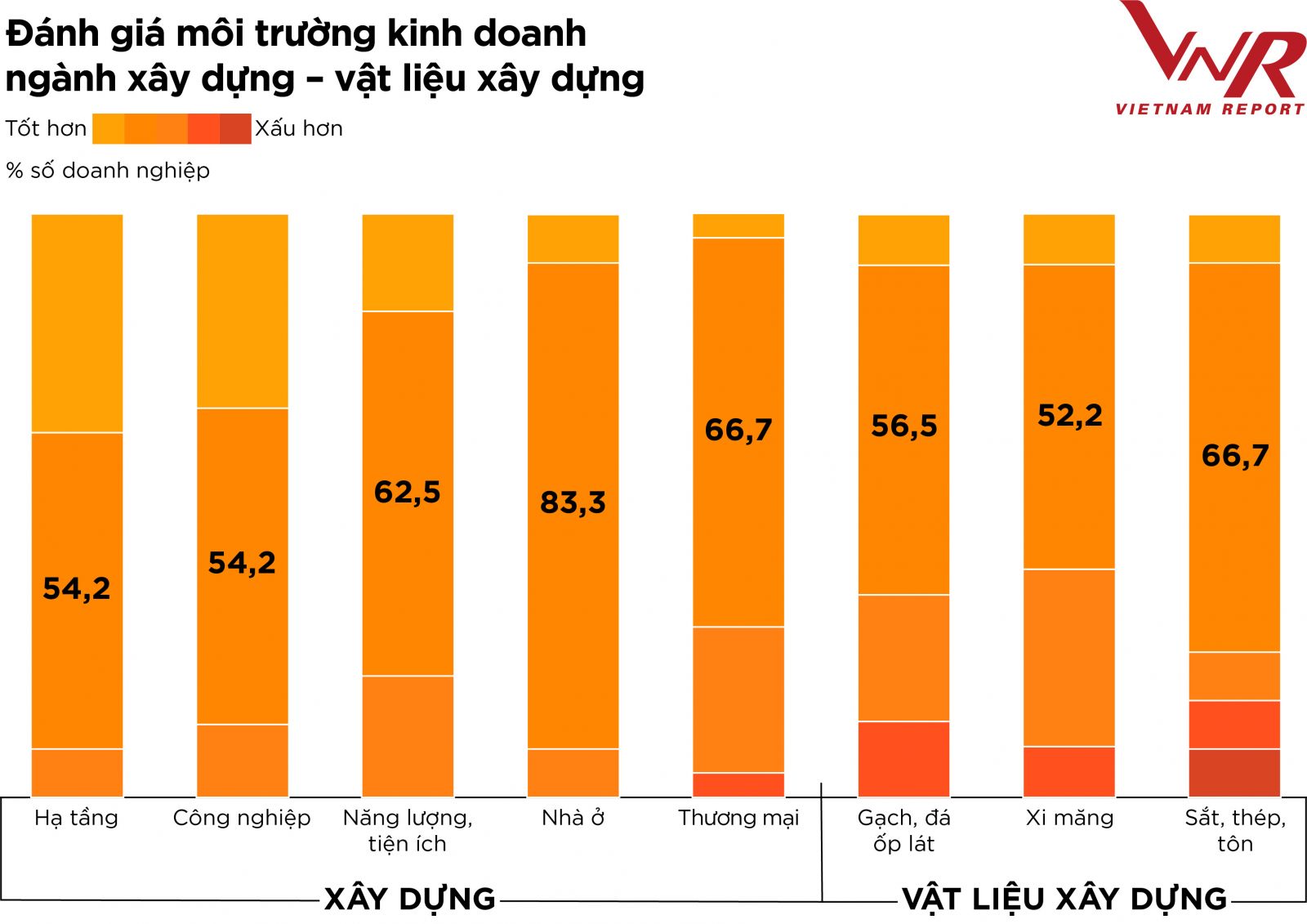

Despite losing its growth momentum before the pandemic, Vietnam's construction market is still a bright spot in the Asia-Pacific region, valued at around 60 billionUSD in 2021 and forecast to grow at a faster rate of more than 8.71% in the period of 2022-2027. A survey by Vietnam Report shows that the majority of enterprises in the industry are optimistic about the industry's prospects in 2022 for all segments. (Figure 5)

Figure 5: Assessment of the business environment in some market segments of the construction - building materials industry

Source: Vietnam Report, Survey of construction and building materials enterprises in 2022, February-March, 2022

Positive signals came from the first months of the year when the backlog (unrealized contract value) of leading civil construction enterprises continued to peak. In addition, FDI inflows continue to pour strongly into Vietnam, which is a bright spot for the industrial construction segment. Specifically, as of March 20, 2022, the total newly and additionally registered FDI capital and share purchase reached nearly 9 billion USD; total disbursed capital is estimated at 4.42 billion USD – this is the highest level compared to the first quarter of the period of 2018-2022. In addition, a series of government support measures recently implemented have been creating new impulses for the enterprises in the industry to recover and accelerate. According to the Resolution on fiscal and monetary policies to support the Socio-economic Recovery and Development Program, a maximum of 176,000 billion VND will be spent on development investment, most of which is investment in transport infrastructure. Also in 2022, the Ministry of Transport is expected to be assigned a medium-term public investment plan of more than 50,000 billion VND by the Government - the largest level ever. The fact that a series of expressway projects will be accelerated in the period of 2022-2025 will open up opportunities for profit breakthrough for the group of enterprises which build transport infrastructure. The need to mobilize large construction materials in projects will also positively affect the group of enterprises of construction steel, construction stone, asphalt and cement in the coming time. Along with that, the legal environment also has some positive changes. Recently, the National Assembly approved the project "1 law amending 8 laws" to remove many legal bottlenecks in the field of construction and real estate. In addition, the Government's Resolution No. 02/2022 on promoting the improvement of the business environment and enhancing national competitiveness is expected to create enough pressure to create drastic changes in economic management thinking, forming a support to help the enterprises in the industry be ready to accelerate and conquer new milestones in 2022 and the following years.

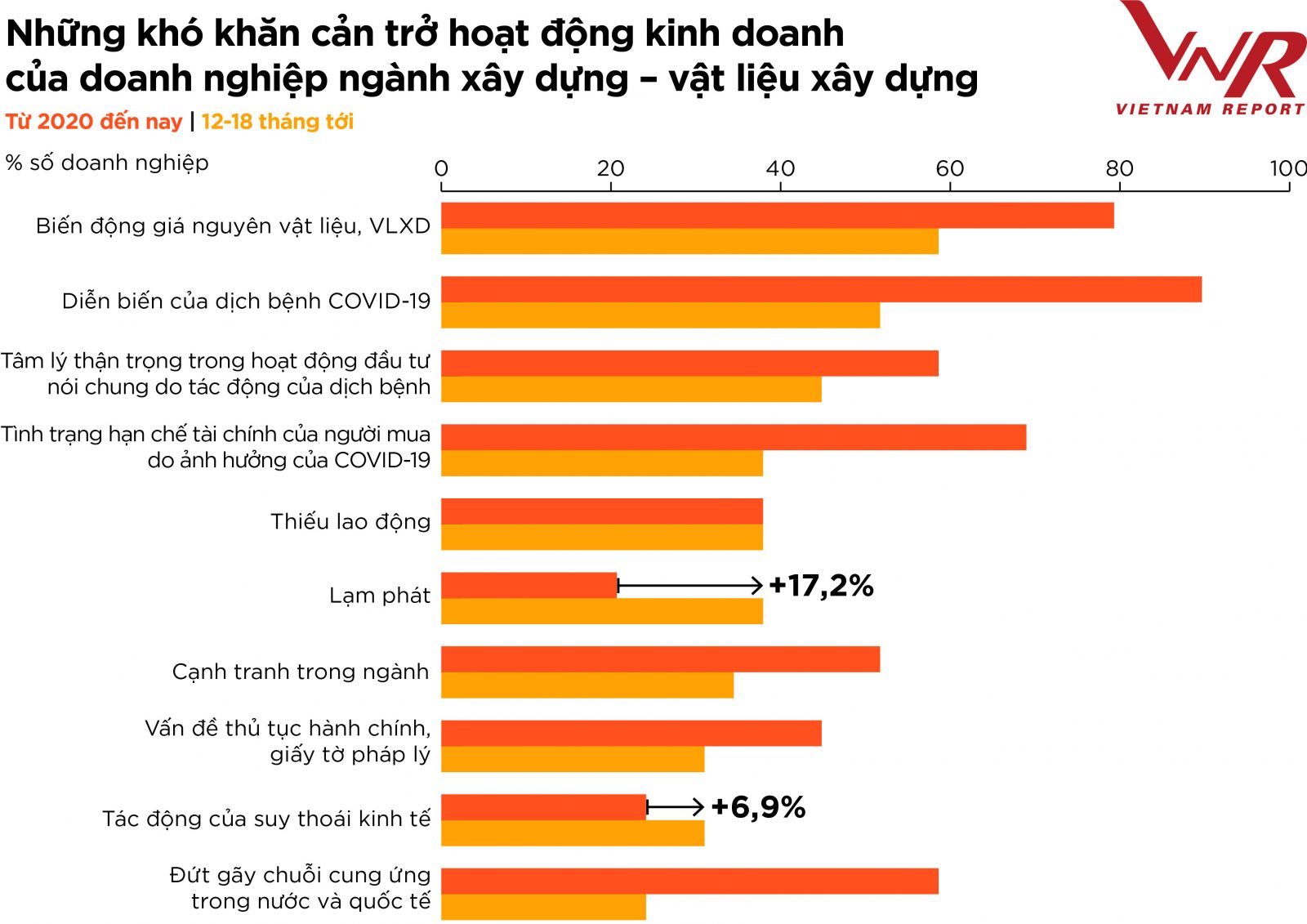

Figure 6: Difficulties hindering business activities of construction and building materials enterprises

Besides the positive signals as analyzed above, the survey of Vietnam Report also shows that the economic picture of the construction - building materials industry still has many challenges (Figure 6). It can be seen that most of the difficulties caused by the pandemic tend to decrease in the next 12-18 months when this crisis is gradually coming to an end, excluding Inflation (+17.2% ) and Impact of economic recession (+6.9%). Last year, Vietnam still successfully controlled inflation when the average consumer price index (CPI) in 2021 of Vietnam only increased by 1.84% over the previous year, the lowest in the past 6 years. However, entering 2022, according to most enterprises and industry experts, inflation pressure is very great because: (1) Consumer demand will increase again when the pandemic is gradually controlled and ended; (2) World commodity prices increased rapidly for some essential commodities and raw materials, fuels and materials used in production due to supply chain disruptions or increased transport costs. Dragon Capital forecasts Vietnam's 2022 inflation from 3.58% to 4.18%. In addition, the political tension between Russia and Ukraine recently has had many impacts on the global market, thereby indirectly affecting the construction - building materials industry in Vietnam through many channels such as world oil prices and world steel prices movements… However, we can expect that with new advances in the negotiation agreement in the coming time, tensions will be reduced and the market will be more stable, creating favourable conditions for the enterprises to be safe in production and business.

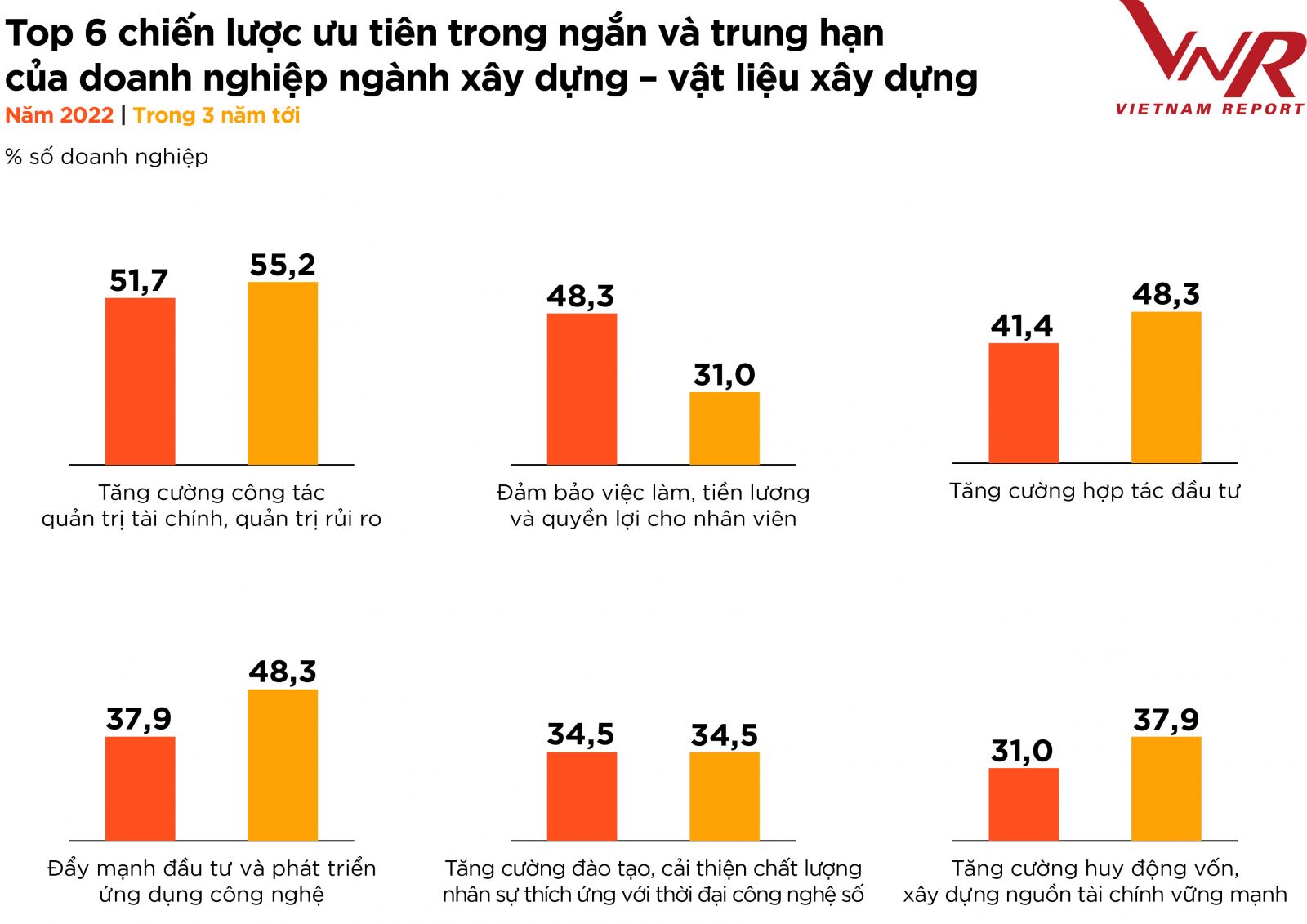

In the context that the entire economy is trying to recover, make up for the losses in the past period, the business strategy of Construction - Building materials enterprises in the short and medium term focuses on into the following six priorities: (1) Strengthening financial management and risk management; (2) Ensuring employment, wages and benefits for employees; (3) Strengthening investment cooperation; (4) Promoting investment and technology development; (5) Strengthening training and improving the quality of human resources to adapt to the digital age; and (6) Increasing capital mobilization, building a strong financial sources. Four of the above six priorities are in the effort to improve the resilience of the business (risk management, financial management and human resource management), creating a competitive advantage for the enterprises in the new period.

Figure 7: Top 6 priority strategies in the short and medium term of enterprises in the construction - building materials industry

Nguồn: Vietnam Report, Khảo sát các DN ngành XD-VLXD năm 2022, tháng 2-3/2022

Sustainable construction trend

Along with improving resilience, the enterprises in the industry also need to capture and effectively exploit new business trends, especially those promoted by the pandemic, one of which is sustainable construction.

At the 26th Conference of Stakeholders on Climate Change (COP26), Vietnam, along with nearly 150 other countries, made strong commitments to bring net emissions to zero (Net Zero) by 2050. This will have a comprehensive impact on the way energy is used as well as many other sectors, including the Construction - Building Materials industry - which accounts for two-thirds of total global CO2 emissions. A survey by Vietnam Report shows that 100% of enterprises are aware of the relevance of sustainability to their business fields. According to the assessment of enterprises in the industry, sustainable construction is gradually approaching environmental, social and governance standards (ESG - Environmental, Social and Governance Criteria), in which focuses on (1) activities to protect the natural environment and effectively use natural resources; (2) improving the quality of life, making progress in social life, while still (3) ensuring economic growth, generating profits without affecting the needs of future generations.

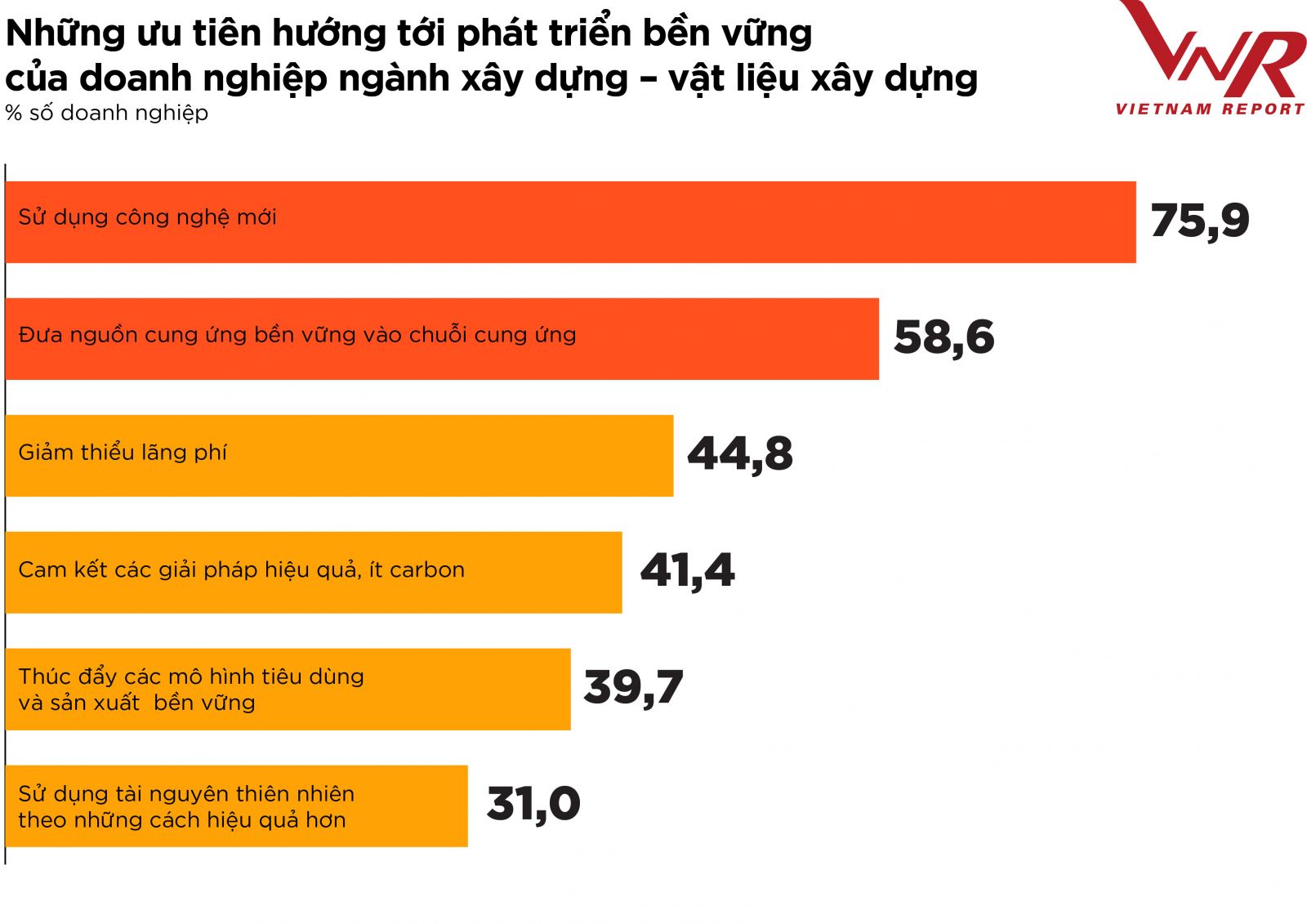

In fact, the trend of sustainable construction has been one of the factors that greatly influenced the business strategy of enterprises in recent years. More and more Employers and home buyers are aiming for "green" criteria in the development of construction projects and housing projects. About 69.2% of enterprises participating in Vietnam Report's survey said that the implementation and fulfillment of the ESG standard assessment criteria affected their winning of contracts/orders or packages. Accordingly, large enterprises in the industry have been applying the green construction model according to strict standards, saving fuel, operating closed and circular stages to create competitive advantages and create value for customers in particular and for the society in general. To achieve the sustainability goal, the 2 priorities chosen by the majority of the enterprises in the industry are: Using new technology (75.9%) and Bringing sustainable sourcing into the supply chain (58.6%).

Figure 8: Priorities towards sustainable development of construction - building materials enterprises

Source: Vietnam Report, Survey of construction and building materials enterprises in 2022, February-March, 2022

However, it should also be noted that the level of implementation of priorities towards sustainable development is still quite slow, until the COVID-19 crisis occurs, forcing us to sit back and consider seriously about the industry's impacts on the environment and climate. As the economy as a whole enters the post-COVID-19 recovery and development phase, it is important to begin integrating the thinking and planning needed to harmonize economic growth goals and sustainable development, minimizing environmental risks. In an interview with Vietnam Report, leaders of large enterprises in the industry said that they are and will be adapting quickly, responding to changes in policies and guidelines of the State and preparing human resources and processes to implementation. In addition, they also shared about common difficulties and problems, needing the synchronization and cooperation of all other ministries - branches - enterprises to understand and work together to achieve the best effect.

The ranking of Top 10 prestigious construction - Building materials companies in 2022 is the result of independent and objective research by Vietnam Report, which has been published annually since 2016, based on the Media Coding method in the media has been applied by Vietnam Report and its partners since 2012, combined with in-depth research into key industries with high growth potential such as: Banking, Insurance, Securities, Pharmaceutical, Food - Beverage, Retail...

The media analysis research method to assess the reputation of companies is based on the Agenda Setting theory on the influence and impact of mass media on the community and society, developed by two professors Maxwell McCombs and Donald L. Shaw was officially announced in 1968, realized and applied by Vietnam Report and its partners. Accordingly, Vietnam Report used the Branch Coding method (evaluating the company's image in the media) to analyze the reputation of enterprises operating in the Construction - Building Materials industry in Vietnam.

Vietnam Report coded articles written about businesses published on influential newspapers in Vietnam during the period from February 2021 to January 2022. The articles are analyzed and evaluated at story-level about 24 specific operational aspects of companies from products, business results, markets... to activities and reputation of company leaders. The information selected for coding is based on two basic principles: The company name appears right on the title of the article, or the news about the mentioned company occupies at least 5 lines in the article, this is called as the cognitive threshold – when the information is judged to be of analytical value. The information is evaluated at the following levels: 0: Neutral; 1: Positive; 2: Quite active; 3: Not clear; 4: Quite negative; 5: Negative. However, the statistics show, the research team gives 3 levels for final evaluation, including: Neutral (including 0 and 3), positive (1 and 2), and negative (4 and 5).

The statements in the announcement are general and for reference only for the enterprises and partners; does not represent personal judgment and does not serve the purposes or needs of any particular Employer. Therefore, relevant parties should carefully consider the appropriateness of the above information before using it to make investment decisions and take full responsibility for the use of such information.

VN

VN